Understanding SWIFT Messaging

4.7

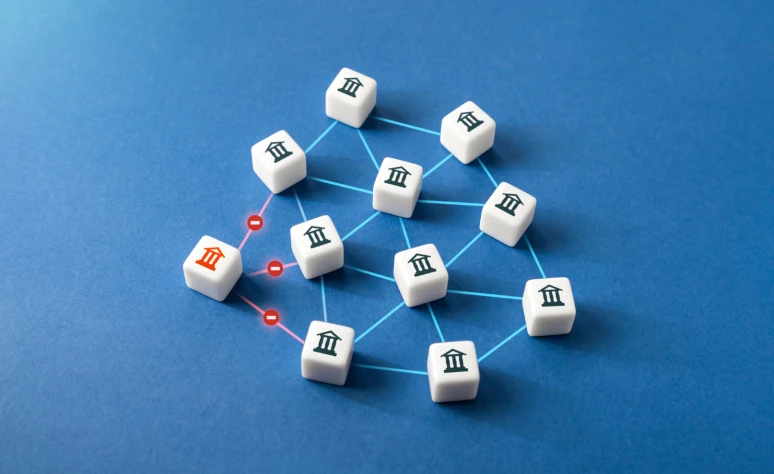

This tailored SWIFT messaging program provides essential knowledge for handling and rectifying SWIFT-related issues within financial transactions and institutions.

Enquire Now